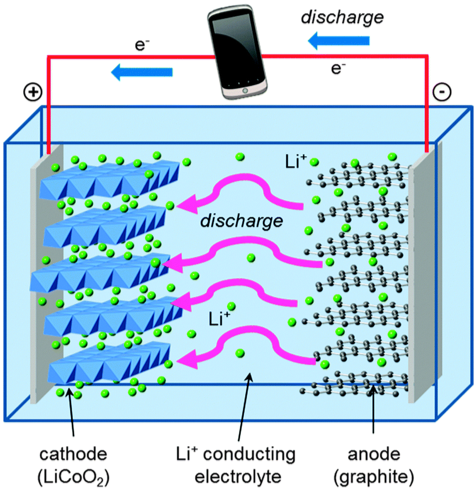

Cobalt is key in emerging low-carbon technologies, specifically lithium-ion batteries in electric vehicles. It  forms part of the cathode active material (for example, lithium cobalt oxide, LiCoO2) that receives positively charged lithium ions during the battery’s discharge (see image on right). (Source: https://sites.psu.edu/hjoisrclbl )

forms part of the cathode active material (for example, lithium cobalt oxide, LiCoO2) that receives positively charged lithium ions during the battery’s discharge (see image on right). (Source: https://sites.psu.edu/hjoisrclbl )

Cobalt’s elemental properties, namely its valence and durability, contribute to the lithium-ion battery’s stability, safety and long useful life. In the wake of the automotive industry’s bold fleet electrification announcements, investors, journalists and technology firms are asking more questions about the electric vehicle value chain and critical raw materials, including cobalt.

I got to find out about some of these questions in Las Vegas in late May. With the desert air approaching 100 degrees, visitors escaped to the casinos’ air-conditioned sanctuaries not only to try their hand at gambling, but also to learn about the cobalt market and to discuss sustainable sourcing and production. While gambling was not in the cards for me, I did attend the Cobalt Institute’s Annual Conference. The institute is a nonprofit trade association whose members represent over 70 percent of annual cobalt production. Every year, over 200 cobalt users, producers, recyclers and traders gather to discuss the status of the industry, buy and sell cobalt products, and devise ways to make the industry more sustainable. Cobalt has gained significant attention in the last year, with metal prices more than doubling to $80,000 per metric ton on the London Metal Exchange (LME).

What and where?

Cobalt is produced primarily as a co-product from copper and nickel mining. With roughly 110,000 metric tons of cobalt produced annually, cobalt is a much tighter market than copper, which produces roughly 20 million metric tons annually. [1] More than half of global cobalt production goes to the battery material market, supplying lithium-ion batteries for laptops, cell phones and electric vehicles. Outside of the battery market, cobalt is used in super alloys for jet engines, petroleum refining catalysts and metal tools. [2] One of its earliest uses was in pigments, hence the color “cobalt blue.”

The Democratic Republic of Congo (DRC) is the leading cobalt producer, accounting for two-thirds of 2017 global cobalt mine production, with other production coming from countries including Australia, Canada, Cuba, Madagascar, Morocco and the Philippines.

The DRC is home to the Central African Copper Belt (in dark green below), one of the most prolific copper deposits in the world. The Copper Belt is a unique sedimentary hosted copper-cobalt deposit that allows for the digging of ore with basic tools. While several large-scale mining (LSM) companies extract and process ores, the ease of ore extraction has allowed many DRC residents to engage in informal or artisanal scale mining (ASM). In 2016, Amnesty International estimated that 110,000 to 150,000 artisanal miners had been extracting ores from informal sites across the Copper Belt.

While ASM is legal and has been a commonplace practice for generations long before the cobalt craze, informal mining sites are often associated with human rights concerns due to lack of adequate government regulation, safety conditions and equipment, and the involvement of child labor. Darton Commodities, a leading cobalt trading firm and market consultancy, estimates that ASM accounted for roughly 15 percent of the DRC’s 2017 cobalt production. Also, because ASM cobalt is often untraceable and mixed with LSM cobalt during the refining process in China, technology manufacturers and producers are grappling with how to ensure socially sustainable cobalt sources.

Toward social sustainability

The Cobalt Institute is leading industry efforts to address social sustainability. “As the industry’s voice on sustainability issues, the Cobalt Institute plays an active role in devising strategies and encouraging market participation in solutions,” said David Weight, the institute’s president. “Through our partnership with RCS Global, the institute’s industry members are collaborating in the production of the Cobalt Industry Risk Assessment Framework (CIRAF). CIRAF allows our members to identify priority risks collaboratively and develop coherent industry standards and verifiable approaches to address these risks.”

Apart from industry-wide efforts, certain firms have independently developed sustainability strategies on the production and sourcing fronts. Glencore, Eurasian Resources Group (ERG), China Molybdenum Co. Ltd. (CMOC) and other producers have developed corporate social responsibility programs that focus on sustainable production and community support in the DRC.

On the sourcing side, Umicore, a Belgian materials technology and recycling group, has pioneered sustainable cobalt sourcing since 2004 via its Sustainable Procurement Framework for Cobalt. Umicore produces various cobalt metal powders, chemicals and rechargeable battery materials. In 2016, Umicore underwent its first cobalt sustainability audit. PriceWaterhouseCoopers (PwC) provided third-party assurance that Umicore’s cobalt purchases were completed within the scope of its four-stage supply chain due diligence process, pictured below.

A key aspect of Umicore’s framework is the flag check system during risk assessment. Ideally, suppliers are flagged green and continue to supply Umicore. Orange flags represent remediable risks that must be addressed, and Umicore often advises and/or collaborates directly with these suppliers to resolve the issues, such as building more robust health and safety systems. Red-flagged suppliers are immediately excluded from Umicore’s supply base. Since instituting its framework and third-party assurance, Umicore has received positive feedback from its automotive and rechargeable battery industry customers and stakeholders who do not want to be associated with unethically mined raw materials. [3]

“Sustainable sourcing contributes not only to our license to operate, but also our license to market. We are committed to creating value in a sustainable manner with our cobalt products,” commented Guy Ethier, Umicore’s SVP of Supply Chain Sustainability. “At Umicore, we apply our skills and know-how with metals to address global issues like resource scarcity and the transition to emerging clean technologies. Sustainability is at the core of this process and allows us to achieve our business mission—materials for a better life.”

[1] “Cobalt” United States Geological Survey. Mineral Commodity Summaries. Published: January 2017. Accessed: 11 February 2018.

[2] “Cobalt Uses.” The Cobalt Institute. Published: 2017. Accessed: 11 February 2018. https://www.cobaltinstitute.org/cobalt-uses.html

[3] “Value Chain Statements – Mitigation Actions.” Umicore Annual Report 2016. Pg. 196 http://annualreport.umicore.com/media/1294/ar2016valuechainen.pdf